| |

|

| |

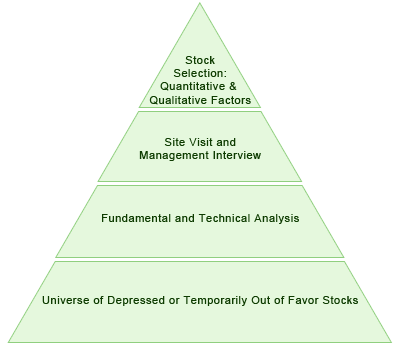

| Bottom-Up Analysis |

|

We believe in a strong bottom-up emphasis to develop our portfolio allocation. At Pheim Singapore, we advocate a value approach to investing. We focus on depressed stocks that are backed by good fundamentals, but are temporarily out of favor. In a nutshell, we seek stocks that are grossly undervalued.

We evaluate a company based on quantitative as well as qualitative factors. We make extensive use of fundamental analysis. We particularly favor stocks that have strong balance sheet (low gearing and strong cash flow position), positive earning dynamics (strong earnings growth, dominant market position and pricing power) and possess attractive financial ratios (low price-to-earnings ratios, price-to-book ratios and high margins). We also conduct technical analysis to look out for stocks that are selling at a historical low.

In our evaluation of a stock, we also consider qualitative factors. We favor companies whose management has good integrity, is capable and focused, and has significant equity interest in the companies. We also expect the companies to be transparent in their operations, and to have satisfactory corporate governance practices. Our fund manager/analysts conduct frequent meetings with company management, including on-site company visits, to gain first hand understanding of the companies' operations. This approach enables us to gain in-depth appreciation of the companies' business so that we are better able to assess the quality of their management. Last, but not least, the prevailing market sentiment and investor psychology is also another factor that is taken into account |

|

|

|

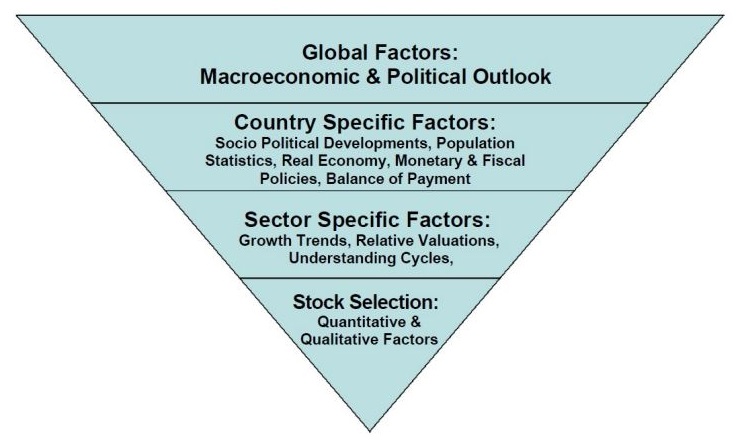

| Top-Down Evaluation |

|

Our top down asset allocation begins with an analysis of the macroeconomic and political

outlook on a global and country basis. We consider various factors like economic growth,

inflation, interest rates, liquidity and the general investor sentiment. Using global outlook as

a guide, we further consider country specific factors like: the socio-political developments,

the population statistics (growth rates, literacy, urbanization), the real economy (GDP growth,

inflation, unemployment, production output, exports and imports, inventory level), the

monetary (interest rates, money supply) and fiscal policies (government spending/budget,

government debt), balance of payment (trade balance, current account balance) before we

decide on country weighting.

Next, we look into factors pertaining to individual sectors of the economy. Sector analysis

focuses on sector growth trends, relative valuations and understanding the cycles that typify

each industry. Some inputs include technology developments, state of competition in the

industry, government policy on privatization and infrastructural development, consumer

spending pattern. We may also make use of technical charts such as Coppock Indicators to

help predict market turning point.

Finally, we conduct our stock selection. Stock selection is based on a meticulous process of

screening based on quantitative as well as qualitative analyses. Some inputs we look into

include valuations, NAV comparisons, management quality and transparency. |

|

|

|

|

|